The Highways Series: Risk Scenario and Accident Cost Analysis

Home » The Highways Series: Risk Scenario and Accident Cost Analysis

In traditional highway financial models, the focus was mainly on traffic growth, travel time savings, and construction costs. These remain important, but they do not necessarily capture the full picture.

Highway planning today incorporates the socio-economic impact of road safety, the cost of inaction, and the risk exposure that exists across the entire project lifecycle. These factors influence both project sustainability and long-term financial outcomes.

The Importance of Road Safety Economics in India

According to the International Road Federation’s World Road Statistics, India records more road deaths than any other country, followed by China and the United States. Each accident results in direct costs such as Human capital costs, medical treatment, emergency response, and loss of income, along with indirect costs such as productivity loss, congestion, asset damage, and long-term disability.

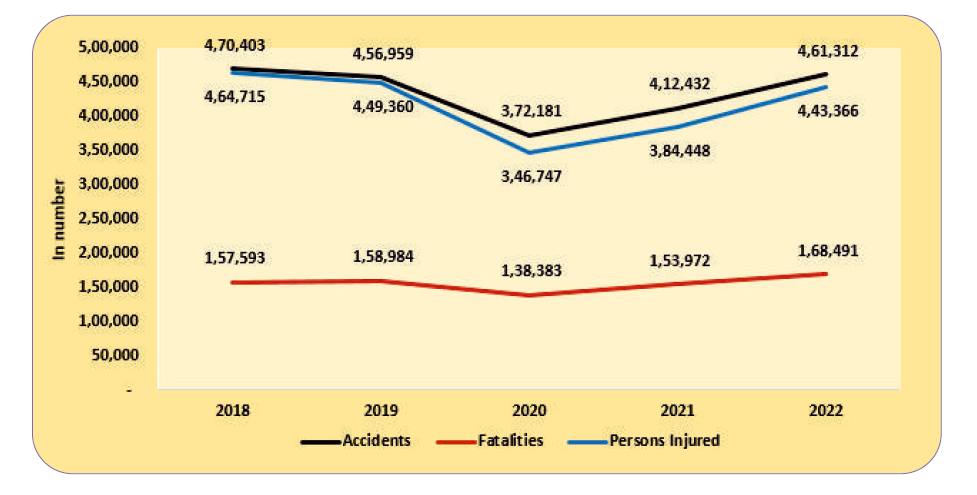

According to the Ministry of Road Transport and Highways (MoRTH), since 2018, more than 150,000 people have lost their lives in road accidents every year. The number of injuries is even higher, making road safety a major challenge. In 2020, the country recorded a decline in road accidents, primarily due to the unprecedented COVID-19 pandemic and the resulting nationwide lockdown, particularly during March–April 2020. This period was followed by a gradual unlocking and phased withdrawal of containment measures. The trend in total accidents, injuries, and fatalities from the period 2018 to 2022 is presented below:

Source: Government of India, Ministry of Road Transport and Highways (MoRTH), Road Accidents in India 2022, Transport Research Wing, Chart 1.1 and Table 1.1

Integrating Risk Scenario Analysis into Highway Planning

risk scenarios, accident costs, and safety frameworks shape project evaluation

Economic evaluation must be able to anticipate uncertainties, rather than relying solely on a single baseline projection. Scenario analysis helps quantify how variations in future conditions influence the financial and economic outcomes of a project.

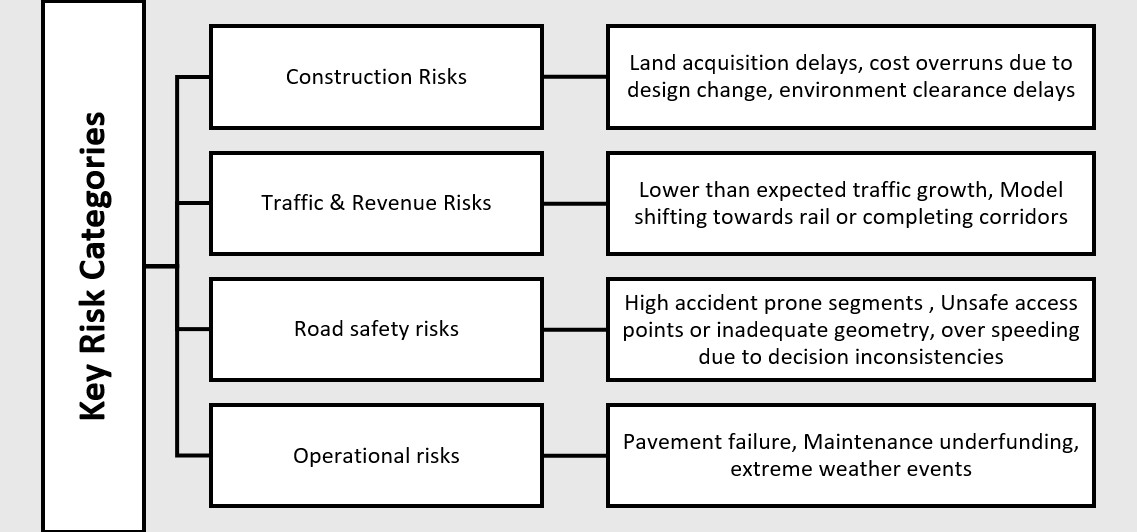

Figure 1: Key risk categories affecting highway project performance

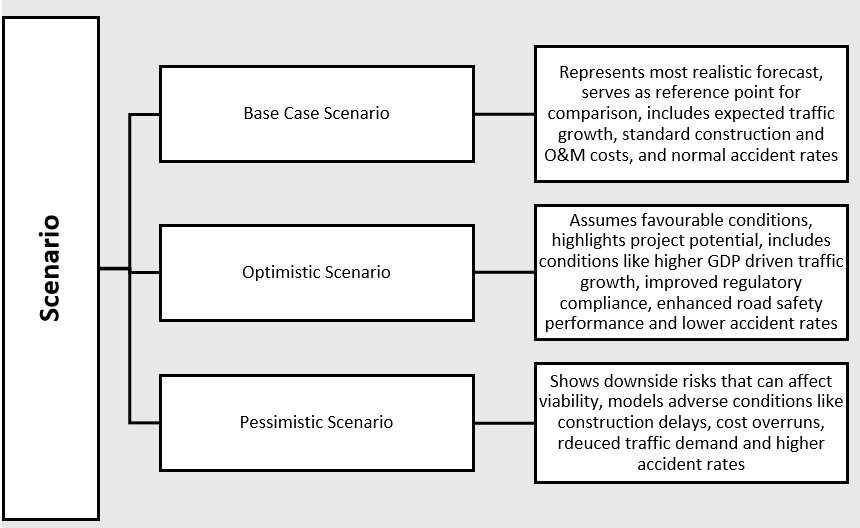

Typically, three scenarios are developed to capture possible changes in demand, costs, or external risks. These scenarios are then evaluated using tools such as Monte Carlo simulations or sensitivity tests. These methods apply a range of possible values for variables like traffic, construction costs, and accident rates. By running many combinations, they reveal the spread of potential outcomes and the probability of each one.

Figure 2: Standard scenario types used in economic and financial evaluation

This process helps identify which assumptions have the greatest influence on project results and whether the project remains viable across different future conditions.

To build a complete view of risk, the evaluation must also consider three related areas. The first is accident cost analysis, which estimates the economic impact of crashes. The second is how accident costs influence financial viability under PPP models. The third is the role of national guidelines that define how safety and risk should be reflected in project appraisal. Together, these components ensure that both economic and financial evaluations reflect real-world conditions

1. Accident cost analysis

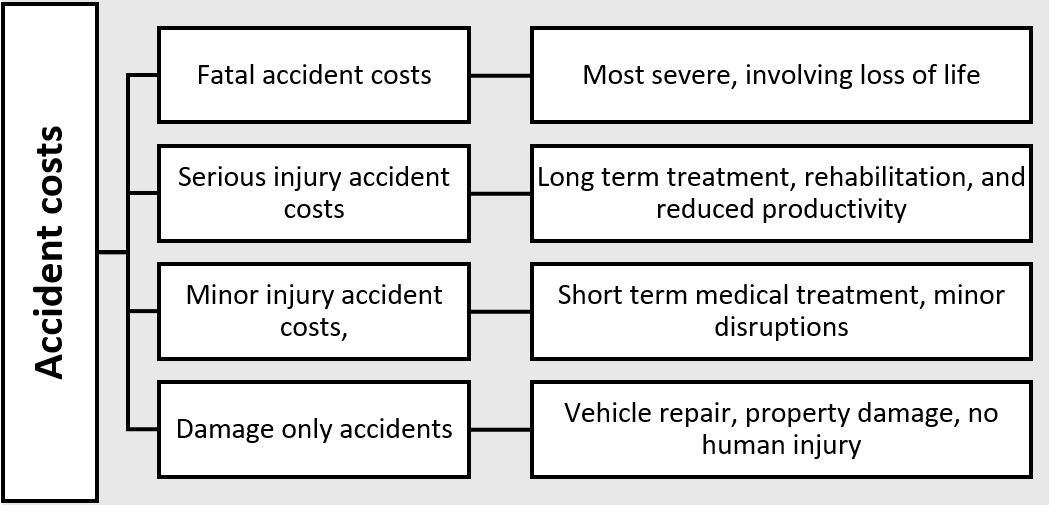

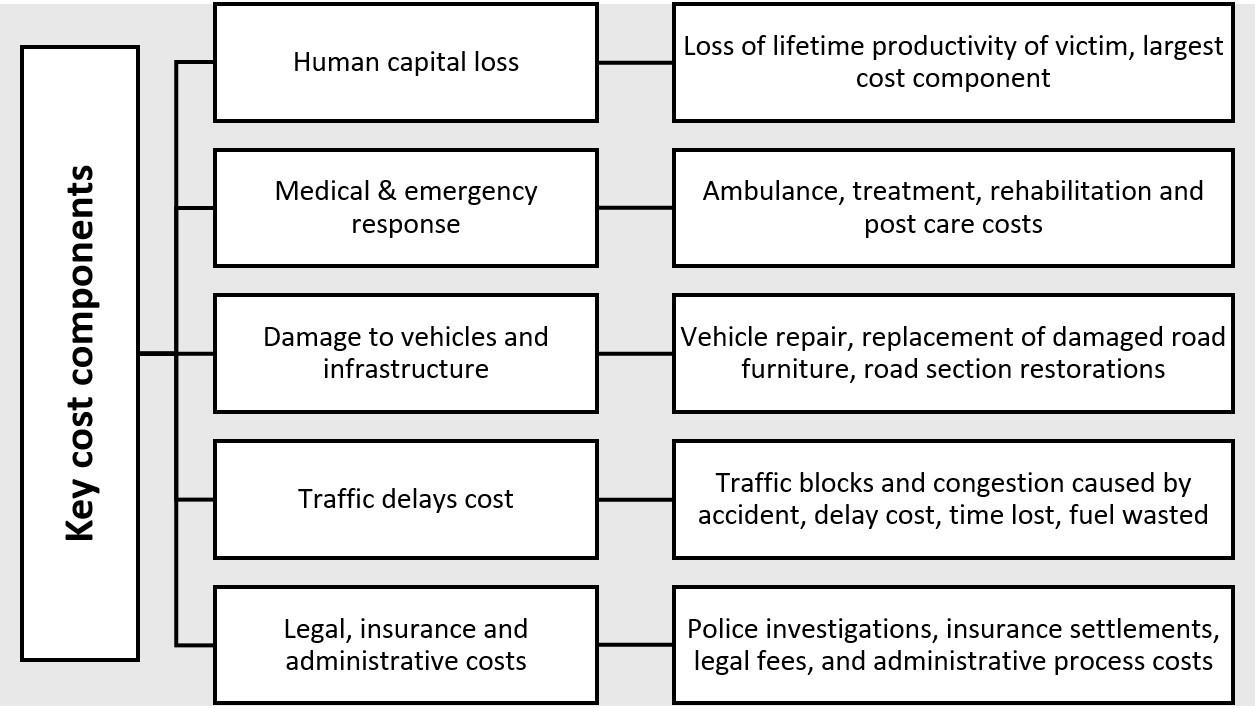

Accident cost analysis estimates the economic burden of road crashes on society. For evaluation purposes, accidents are grouped into four categories based on severity.

Figure 3: Classification of accident cost categories based on severity

A single fatal road accident can impose an economic cost ranging between INR 1 crore and INR 2 crore when the full social and economic impacts are considered. This cost arises from multiple components rather than a single source and includes both direct and indirect expenses.

Blackspot locations experience varying numbers of crashes. Based on crash severity, a severity score is assigned as follows:

- Fatal road crashes: 10

- Serious injury crashes: 5

- Minor injury crashes: 2

- Damage-only crashes: 1

Blackspots with higher cumulative severity scores are prioritised for treatment over other crash locations.

Figure 4: Main components that make up the total cost of road accidents

Reliable accident cost estimation requires strong data inputs, such as:

- Accident records from MoRTH, NHAI and NHIDCL

- Police FIRs and investigation reports

- Hospital records that indicate injury severity

- Traffic volumes and vehicle mix

- Road geometry and blackspot identification

- Crash prediction models to estimate likelihood and frequency of crashes

Understanding these costs allows planners and policymakers to design safer corridors, prioritise blackspot treatment, and direct funding towards locations where interventions have the highest impact.

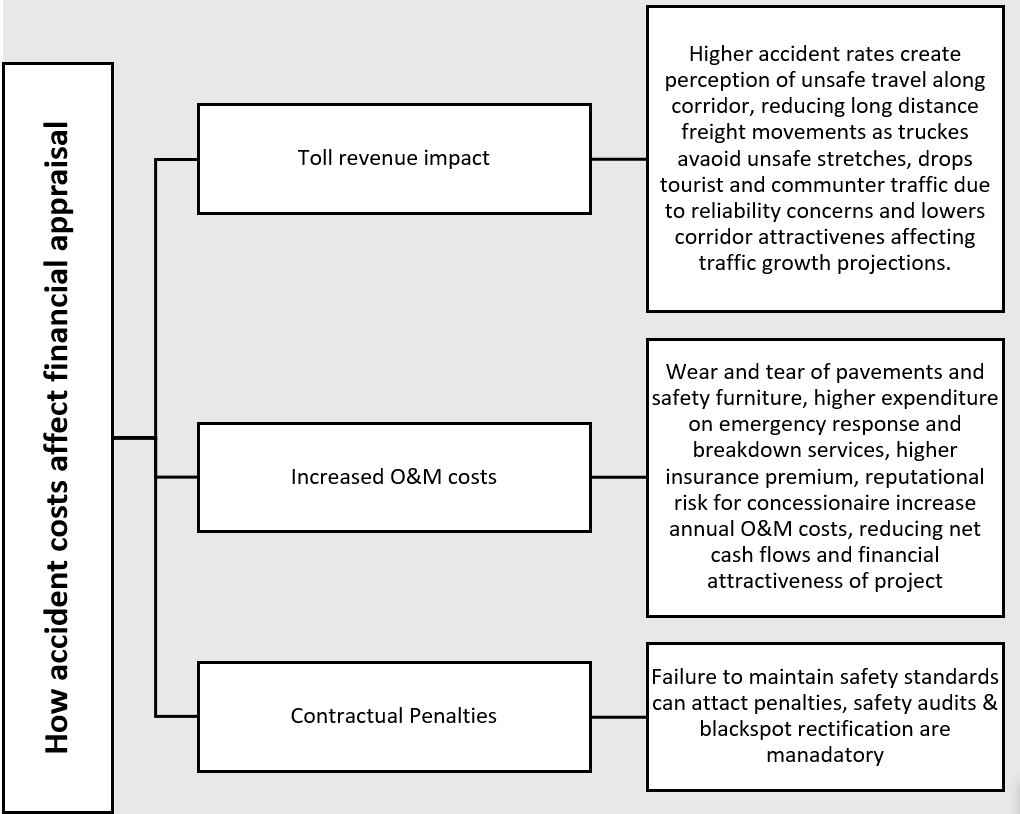

2. Accident cost effects on financial appraisal in PPP projects

Although accident costs are often discussed in the context of economic analysis, they also influence financial performance under PPP structures such as BOT and HAM. Revenue, expenses, and risk are central to investor decisions, yet road safety has a direct bearing on each of these elements.

Accident reduction benefits feed directly into the EIRR of a project. Safety improvements reduce crashes, injuries, and fatalities, which in turn produce monetary savings that strengthen economic returns.

For example, widening a highway or improving its geometry can reduce fatal crashes by up to 40 %. Grade separated interchanges such as flyovers and underpasses lower collision risk. Even low-cost measures such as reflective markings, LED lighting, rumble strips, and traffic calming treatments can meaningfully reduce crash frequency.

Figure 5: How accident costs influence financial appraisal in highway projects.

3. Incorporating safety and risk analysis into official guidelines

India’s highway planning and development ecosystem has increasingly recognised that road safety is not just a design issue but also an economic and financial variable. Several guidelines now embed safety economics and risk analysis in project appraisal.

The following key frameworks reference safety economics:

- IRC: SP -30 – Economic Evaluation of Highway Projects; provides methodologies for including accident cost savings as economic benefits.

- IRC: SP-88 – Road safety Audit; emphasizes safety audit at every project stage, linking design improvements to quantifiable safety outcomes.

- MoRTH’s Blackspot Identification & Treatment guidelines mandate systematic identification, ranking and rectification of accident-prone locations.

- Indian Road safety strategy 2030; promotes data driven interventions, risk reduction targets and adoption of safe system principles.

- NHAI project appraisal guideline encourages inclusion of crash cost estimates, safety benefits and risk adjusted sensitivity analysis in DPR and feasibility studies.

Together, these frameworks support the integration of crash cost estimation, safety led engineering, and structured risk analysis across highway planning.

A Safer Highway is More Economically Viable in the Long Term

Risk assessment and accident cost analysis now play a central role in shaping investment decisions, financing structures, and long-term sustainability for highway projects. Highways that are designed with a clear focus on safety tend to deliver better economic returns through fewer crashes and reduced societal costs. They also reduce operational risk for concessionaires, improve bankability under PPP models, support national safety goals, and build confidence among investors.

When safety economics is integrated into both design and financial appraisal, highways evolve into long term value generating assets. A road that prevents accidents protects families, supports economic productivity, improves operational reliability, and strengthens financial performance. This combination creates one of the most meaningful returns on investment: lives saved and value sustained.

Recent Blogs

Risk and the Limits of Certainty

News Bulletin: January 2026 – Edition 2

My First Conference Experience

News Bulletin: January 2026 – Edition 1

News Bulletin: December 2025 – Edition 2

The Highways Series: Changes in the Regulatory Rulebook

News Bulletin: December 2025 – Edition 1

News Bulletin: November 2025 – Edition 2

Diwali Celebrations at the Eka Infra New Office!