Author: Sourabh Kumar Pandey and Himangi Ahuja

Designation: Assistant Manager – Planning / Advisor - Sales and Marketing

Date: November 10, 2025

When most people think of highways, they picture smoother drives, shorter travel times, and stronger connections between cities and regions. But before a single layer of asphalt is poured, every highway project begins with data. Behind the scenes are spreadsheets, models, and financial forecasts that determine whether a concept can move from blueprint to reality.

Turning those plans into actual roads is a huge task. Highways are among the most capital-intensive projects any country can undertake, requiring major investments in construction, land acquisition, and long-term maintenance. This is where financial modeling becomes essential. It provides the insight needed to evaluate costs, forecast revenues, and manage risks, ensuring that every kilometer built delivers lasting value, not just faster travel.

Why Financial Models Matter?

Before any highway project breaks ground, analysts test whether expected revenues will cover construction, operations, and financing costs over decades. The goal is simple: to ensure the project can sustain itself financially while supporting economic growth.

Financial models convert complex realities such as traffic projections, inflation, interest rates, and policy changes into measurable indicators like the Financial Internal Rate of Return (FIRR), Debt Service Coverage Ratio (DSCR), and payback period. These metrics help determine whether a project can attract investors, meet lender requirements, and justify public spending.

For investors, models outline potential returns and risk exposure. For lenders, they determine repayment reliability. And for governments, they ensure every rupee of public capital is used efficiently, transparently, and with measurable impact. The real value of these models lies in the confidence they build.

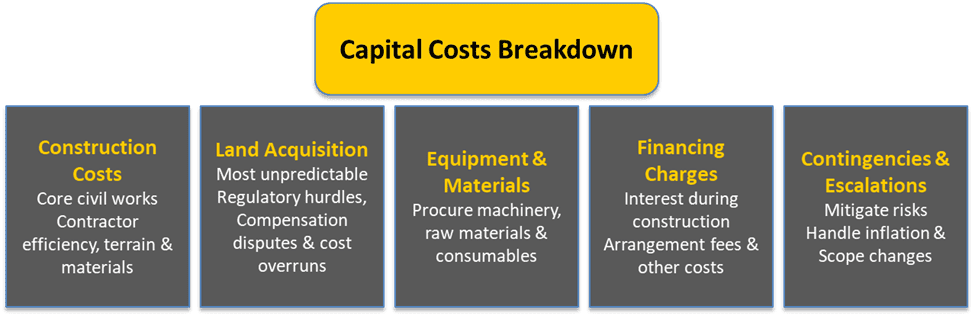

Breakdown of capital costs

Behind every toll plaza lies a complex financial foundation. Construction, land acquisition, and financing are just the start. Even after a highway opens, it continues to incur costs through operations and maintenance that can extend over 20 to 30 years.

Lifecycle costing: O&M, renewals and shocks: Financial models must capture routine maintenance (daily repairs, tolling ops), cyclical major maintenance (resurfacing every 7–10 years), asset renewals, and emergency repairs (floods, landslides). Omitting lifecycle costs understates long-term spend and overstates investor returns. Reliable models discount these flows over concession life and allocate reserves for major maintenance and contingencies.

Traffic demand forecasting: Forecasting combines data and judgement. Analysts rely on origin–destination surveys, historic counts, vehicle registrations, regional GDP, land-use plans and seasonal patterns (festivals, monsoons). Techniques range from regression and econometric models to microsimulation and GIS-based spatial analysis. Strong forecasts also account for:

– Traffic elasticity: how toll changes affect volumes.

– Induced demand: new trips created by better connectivity.

– Modal shifts: movement between road, rail, and air.

– Freight forecasting: demand driven by industrial hubs and logistics corridors.

– Behavioural & tech trends: such as ridesharing, EV adoption, telecommuting, etc.

– Scenario stress tests: including both pessimistic (competing routes, downturns) and optimistic cases.

Good forecasting balances quantitative models with ground validation and conservative judgement.

Macroeconomic assumptions and sensitivity testing: Models embed inflation, interest rates, GDP growth, fuel prices, exchange rates (where foreign inputs or debt exist), and labour market conditions. Sensitivity analysis quantifies how key outputs (FIRR, DSCR) change by even small percentages. Scenario analysis across base, downside, upside, along with break-even calculations helps decision makers understand buffers needed for resilience.

When done right, all these analyses helps highways turn from risky capital sinks into sustainable, revenue-generating assets.

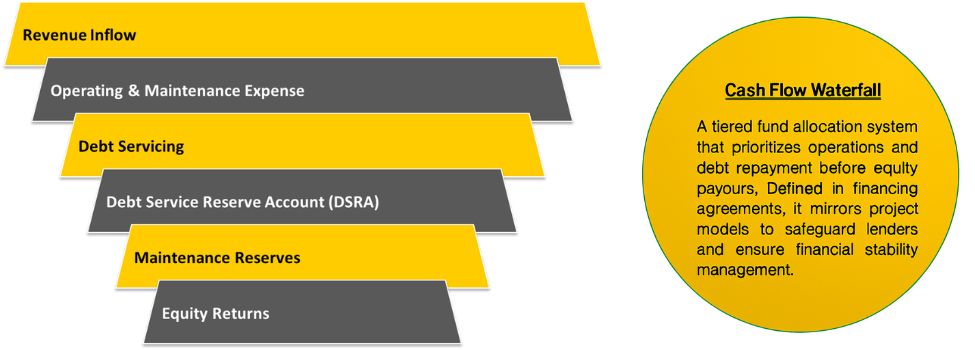

Financial structuring and the cash-flow waterfall

Highway projects typically maintain a debt-to-equity ratio of about 70–80% debt and 20–30% equity. This balance helps maximize leverage while maintaining financial stability.

During construction, Interest During Construction (IDC) adds significantly to project costs before any revenue begins to flow. Managing IDC efficiently reduces early debt strain, and post-construction refinancing can further strengthen returns by lowering interest costs and extending loan tenors.

Credit enhancements such as guarantees, escrow accounts, or reserve mechanisms, improve project creditworthiness. They not only reduce borrowing costs but also build investor and lender confidence.

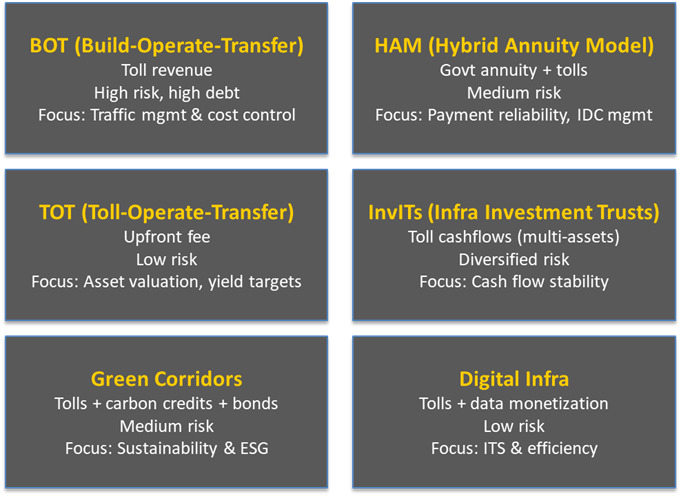

Common financing structures in India include:

- BOT (Build–Operate–Transfer): Toll-driven; the private partner bears high traffic and debt risk but retains upside potential.

- HAM (Hybrid Annuity Model: Government annuities reduce demand risk, with the private party focusing on construction performance.

- TOT (Toll–Operate–Transfer): Monetization via upfront fees; low demand risk for buyer.

- InvITs (Infrastructure Investment Trusts): Portfolio model providing diversification and predictable payouts.

Green corridors, digital integration, blended finance: Emerging mixes of toll revenues, carbon credits, data monetization and concessional capital.

At the heart of any financing plan is the cash flow waterfall, a framework that defines the order in which project cash is distributed. The waterfall governs who gets paid first, how reserves are funded, and when returns flow to equity holders. Its design is critical for protecting lenders, meeting DSCR thresholds, and maintaining financial discipline throughout the project lifecycle.

Risk modelling: Quantifying the unknown

Highway projects face a wide range of risks: construction delays, cost overruns, operations and maintenance gaps, traffic shortfalls, policy shifts, and even environmental disruptions. Financial models quantify these uncertainties and test how they affect a project’s performance.

Below are the key techniques and tools used:

– Deterministic sensitivity analysis: Examines the impact of changing one variable at a time to understand its effect on returns.

– Scenario analysis: Uses base, downside, and upside cases to simulate how variations in traffic, inflation, or financing costs affect key metrics like FIRR, DSCR, and payback period. This helps lenders and investors assess resilience, while allowing governments to calibrate support where necessary.

– Monte Carlo simulations: To run thousands of probability-based scenarios to estimate likely ranges for NPV and IRR outcomes.

– Decision trees: To map different choices and contingent outcomes, such as toll adjustments or refinancing options.

Risk allocation is ultimately reflected in contract structures, guarantees, and credit enhancements. These quantitative insights guide whether a project requires viability gap funding (VGF), sovereign guarantees, or annuity mechanisms to achieve bankability.

Policy, investor perspectives, and lessons learned

India’s policy environment has evolved steadily. Improved model concession agreements, digitized land records, and faster environmental clearances have all enhanced project bankability. Investors now look for transparent cash flows, healthy DSCRs, strong liquidity buffers, and clear refinancing pathways. Lenders, on their part, expect escrow accounts, structured payment triggers, and conservative covenants to safeguard capital.

Global experience in public–private partnerships reinforce the importance of realistic traffic forecasts, clear risk-sharing frameworks, and efficient dispute resolution mechanisms. Instruments like InvITs, TOT models for asset recycling, and blended finance are signs of a maturing market that values scale while keeping risk in check.

Emerging trends and the road ahead

Electronic tolling and intelligent transport systems are improving revenue predictability and operational efficiency. Green financing, carbon-linked instruments, and ESG screening are unlocking new pools of capital. Digital data, ranging from traffic analytics to logistics movement, offers new monetization opportunities beyond tolls.

At the same time, blended finance and concessional multilateral capital are helping de-risk early-stage projects, while InvITs continue to attract long-term institutional investors. As financial models become more data-driven and transparent, project selection, pricing, and risk-sharing will keep improving, turning highways into resilient, future-ready infrastructure.

Let’s Conclude

Financial modeling does far more than project returns. It defines a highway’s economic life, allocates risks, and aligns public and private incentives. When models are rigorous, transparent, and tested under pressure, they transform uncertainty into investment-grade opportunities that create lasting economic and social value.

Recent Blogs

News Bulletin: February 2026 – Edition 1

Risk and the Limits of Certainty

News Bulletin: January 2026 – Edition 2

My First Conference Experience

News Bulletin: January 2026 – Edition 1

The Highways Series: Risk Scenario and Accident Cost Analysis

News Bulletin: December 2025 – Edition 2